Raise Your Financial Health And Wellness with Tailored Loan Service

Raise Your Financial Health And Wellness with Tailored Loan Service

Blog Article

Explore Specialist Finance Providers for a Smooth Borrowing Experience

In the realm of monetary transactions, the quest for a seamless loaning experience is usually searched for however not quickly achieved. Professional lending services supply a pathway to navigate the intricacies of borrowing with precision and knowledge. By straightening with a trusted loan provider, individuals can unlock a wide variety of benefits that expand past simple financial purchases. From tailored lending solutions to tailored advice, the globe of specialist finance services is a realm worth discovering for those looking for a loaning journey noted by effectiveness and simplicity.

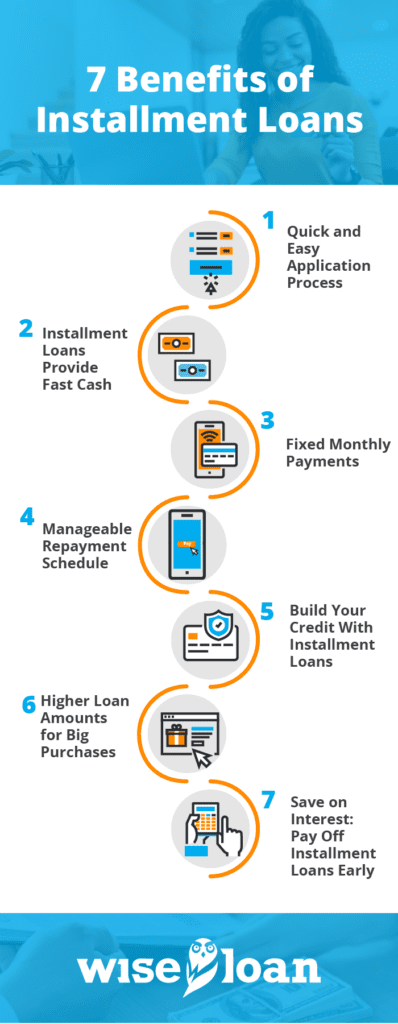

Benefits of Specialist Financing Services

When thinking about financial alternatives, the advantages of using specialist loan services come to be apparent for people and businesses alike. Professional loan solutions offer know-how in browsing the complex landscape of borrowing, supplying customized remedies to fulfill particular economic needs. One significant benefit is the access to a large array of finance items from different lending institutions, allowing customers to pick one of the most suitable choice with desirable terms and rates. Additionally, specialist lending solutions often have actually established relationships with loan providers, which can result in faster approval processes and much better settlement outcomes for customers.

Selecting the Right Car Loan Service Provider

Having identified the advantages of professional car loan solutions, the next critical action is choosing the right financing provider to meet your specific economic needs efficiently. mca lending. When picking a financing company, it is crucial to think about numerous key elements to make sure a seamless loaning experience

Firstly, review the credibility and credibility of the car loan provider. Study consumer evaluations, ratings, and reviews to assess the complete satisfaction degrees of previous customers. A reliable lending provider will have transparent conditions, excellent customer support, and a record of integrity.

Secondly, contrast the interest prices, charges, and payment terms supplied by various funding carriers - best business cash advance loans. Seek a service provider that offers affordable prices and versatile repayment alternatives tailored to your financial circumstance

Furthermore, consider the financing application procedure and approval duration. Go with a company that supplies a structured application process with fast authorization times to accessibility funds promptly.

Simplifying the Application Refine

To enhance efficiency and benefit for applicants, the finance company has actually executed a structured application procedure. This polished system aims to simplify the loaning experience by lowering unneeded documentation and expediting the authorization process. One vital function of this streamlined application procedure is the online system that enables applicants to submit their information electronically from the convenience of their very own homes or workplaces. By removing the need for in-person visits to a physical branch, candidates can conserve time and finish the application at their benefit.

Understanding Finance Conditions

With the streamlined application process in place to simplify and quicken the loaning experience, the following critical step like it for applicants is getting an extensive understanding of the lending terms. Understanding the conditions of a finance is crucial to guarantee that customers recognize their responsibilities, rights, and the overall expense of loaning. Secret facets to pay attention to include the rate of interest, repayment schedule, any associated costs, fines for late settlements, and the complete quantity repayable. It is vital for customers to carefully review and comprehend these terms prior to accepting the financing to stay clear of any type of surprises or misunderstandings in the future. Furthermore, customers ought to ask about any type of conditions connected to early settlement, refinancing options, and prospective adjustments in rates of interest with time. Clear communication with the lending institution concerning any unpredictabilities or inquiries concerning the terms and conditions is urged to foster a transparent and mutually helpful borrowing partnership. By being knowledgeable about the finance terms and conditions, debtors can make sound economic choices and navigate the borrowing process with self-confidence.

Taking Full Advantage Of Car Loan Approval Opportunities

Securing authorization for a funding demands a tactical strategy and detailed prep work on the part of the borrower. Furthermore, lowering existing financial obligation and preventing taking on new financial debt prior to applying for a loan can demonstrate monetary duty and improve the chance of approval.

Moreover, preparing an in-depth and practical budget that outlines income, costs, and the recommended funding settlement strategy can showcase to lenders that the consumer can handling the additional financial obligation (same day merchant cash advance). Providing all needed documentation promptly and accurately, such as proof of revenue and work background, can enhance the approval procedure and instill confidence in the lender

Final Thought

To conclude, expert lending services use various advantages such as experienced guidance, customized loan choices, and increased approval possibilities. By choosing the appropriate car loan service provider and recognizing the terms, customers can streamline the application procedure and make certain a seamless borrowing experience (Financial Assistant). It is very important to thoroughly consider all facets of a loan before devoting to guarantee financial stability and effective payment

Report this page