Browse Your Financial Resources with Expert Loan Service Assistance

Browse Your Financial Resources with Expert Loan Service Assistance

Blog Article

Explore Specialist Car Loan Services for a Smooth Borrowing Experience

In the realm of economic deals, the quest for a seamless loaning experience is commonly searched for yet not conveniently attained. Specialist financing solutions provide a path to browse the complexities of loaning with precision and competence. By aligning with a reputable loan company, people can open a wide range of benefits that prolong past simple monetary purchases. From customized car loan solutions to individualized support, the globe of professional lending services is a realm worth exploring for those seeking a loaning trip marked by effectiveness and convenience.

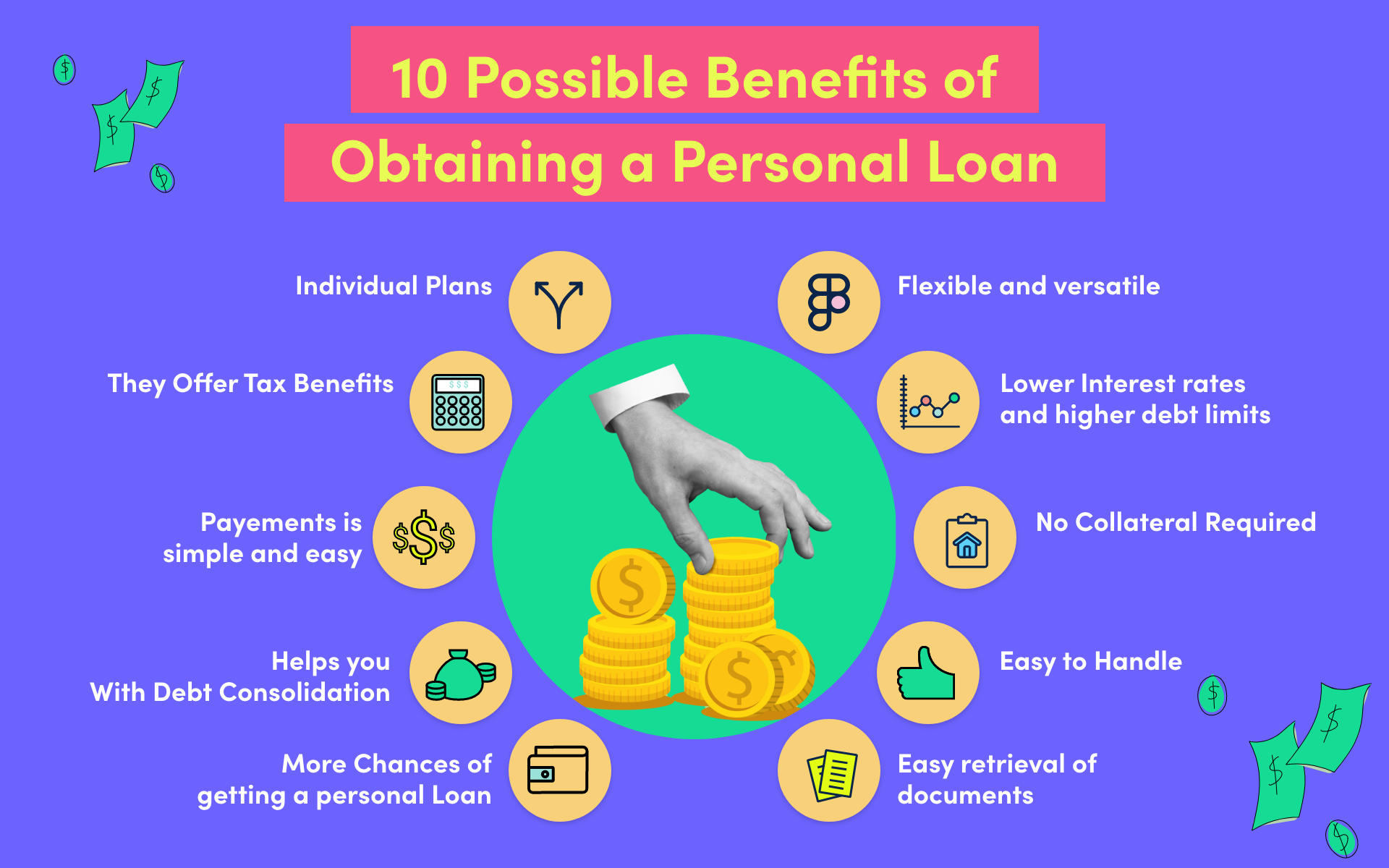

Benefits of Expert Lending Solutions

When considering economic options, the benefits of using professional funding services end up being evident for people and organizations alike. Specialist loan services supply expertise in browsing the facility landscape of loaning, supplying customized remedies to meet particular economic demands. One significant advantage is the access to a large range of lending items from different lending institutions, allowing clients to pick one of the most ideal alternative with desirable terms and prices. Expert car loan services typically have developed partnerships with lenders, which can result in faster authorization procedures and much better arrangement results for borrowers.

Picking the Right Car Loan Company

Having actually identified the advantages of professional finance solutions, the next important action is selecting the ideal car loan provider to fulfill your details economic requirements efficiently. mca loans for bad credit. When picking a lending supplier, it is necessary to think about numerous vital factors to make sure a seamless loaning experience

To start with, examine the credibility and trustworthiness of the lending service provider. Study customer testimonials, rankings, and testimonies to evaluate the satisfaction levels of previous customers. A trusted finance copyright will have transparent conditions, excellent consumer service, and a track record of reliability.

Second of all, compare the rate of interest, charges, and payment terms used by different finance companies - quick mca funding. Seek a company that offers affordable rates and versatile payment alternatives customized to your financial situation

Additionally, consider the lending application process and authorization duration. Choose a service provider that offers a structured application procedure with fast approval times to access funds without delay.

Enhancing the Application Process

To improve efficiency and benefit for candidates, the funding company has actually applied a streamlined application procedure. One essential function of this structured application procedure is the online platform that allows applicants to send their info electronically from the convenience of their own homes or workplaces.

Understanding Loan Terms and Problems

With the structured application process in position to simplify and quicken the loaning experience, the next critical action for candidates is gaining a comprehensive understanding of the financing conditions. Recognizing the conditions of a loan is vital to ensure that borrowers are conscious of their responsibilities, legal rights, and the overall price of loaning. Secret elements to focus on consist of the rate of interest, payment timetable, any type of affiliated costs, penalties for late payments, and the total quantity repayable. It is important for customers to thoroughly examine and understand these terms before accepting the financing to prevent any type of shocks or misunderstandings in the future. In addition, borrowers must make inquiries concerning any kind of provisions connected to early settlement, re-financing alternatives, and prospective changes in rate of interest gradually. Clear interaction with the loan provider regarding any unpredictabilities or queries concerning the terms and conditions is motivated to cultivate a clear and mutually helpful loaning partnership. By being well-informed concerning the financing terms, consumers can make sound economic choices and browse the borrowing procedure with confidence.

Making The Most Of Financing Approval Opportunities

Safeguarding approval for a financing requires a tactical technique and complete prep work on the component of the consumer. To take full advantage of loan approval opportunities, people should begin by assessing their credit report records for precision and attending to any kind of discrepancies. Maintaining an excellent credit rating is essential, as it is a substantial element thought about by lenders when evaluating credit reliability. In addition, reducing existing financial obligation and avoiding taking on brand-new debt before applying for a read finance can demonstrate economic obligation and improve the likelihood of authorization.

In addition, preparing a comprehensive and reasonable spending plan that outlines revenue, expenses, and the recommended funding repayment plan can showcase to lenders that the debtor is qualified of handling the additional monetary obligation (mca funders). Offering all necessary paperwork immediately and precisely, such as proof of income and employment background, can enhance the authorization process and impart self-confidence in the loan provider

Final Thought

Finally, professional loan services offer numerous advantages such as experienced advice, tailored lending options, and enhanced authorization possibilities. By selecting the best loan company and recognizing the conditions, debtors can improve the application procedure and make sure a smooth borrowing experience (Financial Assistant). It is necessary to very carefully take into consideration all facets of a finance prior to committing to guarantee economic stability and successful settlement

Report this page